In recent years, the financial industry has seen a major transformation with the rise of fintech companies. These innovative startups are using cutting-edge technology, specifically artificial intelligence (AI), to disrupt traditional banking methods and provide efficient solutions for customers. As a result, fintech banks are quickly gaining traction and becoming leaders in the financial sector.

Toc

- 1. Introduction to Fintech Banking and AI

- 2. Benefits of Fintech Banking for Tech-Savvy Consumers and Small Business Owners

- 3. Related articles 01:

- 4. Services Offered by Fintech Banks

- 5. Fintech vs. Traditional Banks: A Comparison

- 6. Future Trends in Fintech Banking and AI Integration

- 7. Related articles 02:

- 8. Case Studies and Real-World Examples of Fintech Banks Utilizing AI for Business Growth

- 9. Conclusion

Introduction to Fintech Banking and AI

The financial technology (fintech) revolution has transformed the traditional banking landscape, making financial services more accessible, affordable, and efficient. At the heart of this transformation is artificial intelligence (AI), which is driving unprecedented innovation in the sector. For tech-savvy consumers and small business owners, fintech banks offer a glimpse into the future of banking.

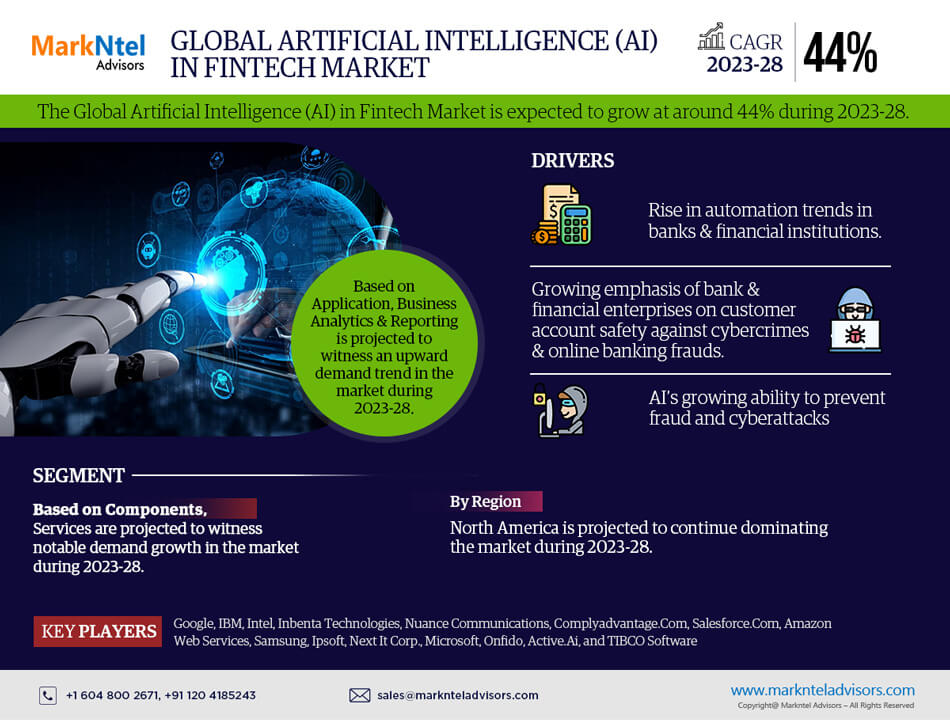

AI’s integration in fintech banking is not just about automation; it’s about creating a more inclusive financial ecosystem that caters to the unique needs of each user. From personalized financial advice to real-time fraud detection, AI is reshaping the way we interact with our finances.

What is Fintech?

Fintech, or financial technology, refers to any company that uses technology to improve or automate financial services. This can include mobile payment apps, online lending platforms, cryptocurrency exchanges, and more. Fintech companies aim to make financial transactions faster, easier, and more cost-effective for consumers.

The Role of AI in Fintech Banking

AI is the driving force behind many of the innovative solutions provided by fintech banks. By using AI algorithms and machine learning, these banks are able to analyze vast amounts of data in real-time and make personalized recommendations for customers.

Some common use cases of AI in fintech banking include:

- Fraud detection: AI can quickly identify patterns and anomalies in transactions, helping to prevent fraud and protect customer accounts.

- Credit scoring: Traditional credit scoring methods may not always accurately reflect a person’s creditworthiness. Fintech banks use AI models to take into account a variety of data points, such as social media activity or education level, to provide more accurate credit assessments.

- Chatbots: AI-powered chatbots provide 24/7 customer support, answering frequently asked questions and assisting with basic banking tasks.

- Investment management: Fintech banks use AI algorithms to analyze market trends and make personalized investment recommendations for customers.

How Fintech Banks are Changing the Game

Fintech banks are disrupting traditional banking methods in many ways. Firstly, they offer faster and more convenient services, allowing customers to open accounts online, transfer money instantly, and access financial advice on demand. This is especially appealing to younger generations who value speed and convenience.

In addition, fintech banks have lower overhead costs compared to traditional banks, which allows them to offer competitive interest rates and lower fees. They are also more agile and adaptable, constantly incorporating new technologies to improve their services.

Furthermore, fintech banks are catering to underserved populations such as immigrant communities or small businesses that may have been overlooked by traditional banks. With the help of AI, these banks can provide tailored financial solutions to meet the specific needs of these customers.

Benefits of Fintech Banking for Tech-Savvy Consumers and Small Business Owners

Accessibility

Fintech banks provide 24/7 access to banking services through digital platforms, making it easier for consumers to manage their finances from anywhere at any time. This on-demand service is particularly appealing to tech-savvy consumers who are accustomed to instant access and convenience.

1. https://cacutproapk.com/mmoga-ai-for-small-business-a-transformative-guide

2. https://cacutproapk.com/mmoga-ai-in-manufacturing-transforming-production-and-profitability-2

4. https://cacutproapk.com/mmoga-ai-ops-transforming-it-management-for-the-future

5. https://cacutproapk.com/mmoga-conversational-ai-transforming-business-communications

Cost-Efficiency

One of the most significant advantages of fintech banks is their cost-efficiency. With lower fees and transparent pricing models, fintech banks can help small businesses reduce operational costs. This is especially beneficial for startups and small enterprises that need to manage their budgets carefully.

Innovation

Fintech banks are constantly innovating to offer new products and services that meet the evolving needs of their customers. The integration of AI is a prime example of this innovation, providing features that were previously unimaginable in traditional banking.

Services Offered by Fintech Banks

Mobile Banking

Mobile banking apps from fintech banks offer unparalleled convenience and functionality. Customers can check their balances, transfer funds, pay bills, and even apply for loans—all from their smartphones. This level of accessibility is crucial for busy professionals and small business owners.

Digital Payments

Fintech banks offer a variety of digital payment options, including peer-to-peer transfers, contactless payments, and secure online shopping. These services make it easier for consumers to complete transactions quickly and securely, whether they’re paying a friend or shopping online.

AI-Driven Financial Planning

AI-driven financial planning tools provide personalized advice and insights based on a customer’s spending behavior and financial goals. By analyzing vast amounts of data, these tools can offer tailored recommendations that help users make more informed financial decisions.

Fintech vs. Traditional Banks: A Comparison

Traditional banks have been around for centuries and offer a sense of stability and familiarity. However, they also come with limitations such as restricted hours, long wait times, and complex processes. Fintech banks, on the other hand, offer convenience, speed, and innovation.

Accessibility

In addition to extended operating hours, fintech banks provide a seamless user experience through their digital platforms. Customers can access their accounts, make transactions, and receive support at any time of day, eliminating the constraints posed by traditional banking hours. This round-the-clock accessibility is particularly significant for individuals with busy schedules or those living in different time zones. Moreover, many fintech banks offer tailored mobile applications that are designed with user-friendly interfaces, making banking services intuitive and straightforward for users of all ages. This focus on accessibility ensures that everyone, regardless of their technological prowess, can effectively manage their finances with ease.

Security Measures

Security is a paramount concern for consumers in the digital banking landscape. Fintech banks are leveraging advanced technologies such as biometric authentication and encryption to safeguard their customers’ data. These measures not only protect against unauthorized access but also instill greater confidence among users regarding the safety of their transactions. Furthermore, fintech banks regularly update their security protocols to stay ahead of emerging threats, ensuring that they can effectively counteract fraud and cyberattacks. By prioritizing security, fintech banks create a trustworthy environment that encourages customer loyalty and engagement.

Future Trends in Fintech Banking

Looking ahead, fintech banking is poised for continued growth and transformation. As technology evolves, we can anticipate the rise of even more innovative solutions, such as augmented reality interfaces and blockchain-based transactions, enhancing user experience and trust. Additionally, the integration of big data analytics will allow fintech banks to refine their offerings, providing hyper-personalized services that cater to individual financial behaviors and preferences. As financial literacy improves among consumers, the demand for intuitive and fully accessible banking solutions will only increase, positioning fintech banks at the forefront of the financial services industry.

Future Trends in Fintech Banking and AI Integration

The integration of AI in fintech banking is a continuously evolving process, with new trends and developments emerging constantly. Some potential future trends include:

Predictive Analytics

Predictive analytics is poised to play a pivotal role in the future of fintech banking. By leveraging advanced algorithms and machine learning techniques, fintech banks can anticipate customer needs and behaviours more accurately than ever before. This capability will enable them to tailor products and services to individual preferences, ensuring a highly personalized banking experience. For example, predictive analytics can help identify when a customer is likely to need a loan or may benefit from investment opportunities, allowing banks to proactively offer their services. Additionally, it can assist in risk management by identifying potential financial pitfalls before they occur, empowering consumers with timely insights to make informed decisions. As fintech banks continue to refine their analytical capabilities, the overall customer experience is expected to improve, fostering greater loyalty and satisfaction among users.

1. https://cacutproapk.com/mmoga-ai-for-small-business-a-transformative-guide

2. https://cacutproapk.com/mmoga-conversational-ai-transforming-business-communications

3. https://cacutproapk.com/mmoga-ai-ops-transforming-it-management-for-the-future

5. https://cacutproapk.com/mmoga-ai-in-manufacturing-transforming-production-and-profitability-2

Enhanced Security Measures

As digital banking becomes increasingly prevalent, enhanced security measures will be critical to protect consumer data and build trust in fintech banks. Future developments may include advanced biometric authentication methods, such as facial recognition or fingerprint scanning, to ensure that only authorized users can access their accounts. Furthermore, blockchain technology could be integrated to provide a secure and transparent way to manage transactions, significantly reducing the likelihood of fraud and data breaches. By prioritising security, fintech banks can reassure customers that their financial information is safeguarded, which is essential for long-term growth and sustainability.

Regulatory Compliance

With the rapid evolution of fintech banking, regulatory compliance will also be a significant focus moving forward. As new technologies and business models emerge, regulators are likely to adapt existing frameworks or create new ones to address the unique challenges of the fintech landscape. Fintech banks will need to stay ahead of these changes by investing in compliance technology and practices that ensure adherence to regulations. This proactive approach will not only mitigate risks but also enhance the credibility of fintech institutions in the eyes of consumers and investors alike.

Integration of Cryptocurrency Services

The growing interest in cryptocurrencies presents a unique opportunity for fintech banks to expand their service offerings. By integrating cryptocurrency transactions and wallets, these banks can cater to a new demographic of tech-savvy consumers who are eager to explore digital assets. Additionally, offering educational resources about cryptocurrency investing and blockchain technology could position fintech banks as leaders in this emerging market, attracting a broader customer base. As regulations around cryptocurrencies continue to evolve, fintech banks that embrace this trend will likely lead the charge in redefining the future of financial services.

Case Studies and Real-World Examples of Fintech Banks Utilizing AI for Business Growth

Some real-world examples of fintech banks successfully leveraging AI for business growth include:

Capital One

Capital One, a US-based bank, has been at the forefront of integrating AI into their digital banking services. They have developed Eno, an intelligent assistant that uses natural language processing to handle customer inquiries and perform tasks such as transferring funds or tracking expenses. Eno also utilizes machine learning to analyze customer spending patterns and offer personalized financial advice. This AI integration has resulted in improved efficiency, reduced costs, and enhanced user experience for Capital One customers.

Lloyds Banking Group

Lloyds Banking Group, a UK-based bank, has implemented AI-powered chatbots to handle customer inquiries and complaints. These bots use natural language processing and machine learning to understand and respond to customer queries accurately. By automating these processes, Lloyds has been able to reduce call center volume by 20%, freeing up resources to focus on more complex customer needs. This integration has not only increased efficiency but also improved customer satisfaction with faster response times.

Ant Financial

Ant Financial, a Chinese fintech company, has utilized AI and big data analytics to provide microloans to small businesses. By analyzing a vast amount of data points such as online shopping habits and social media interactions, Ant Financial can determine the creditworthiness of potential borrowers quickly. This efficient process has allowed them to issue loans in minutes, significantly reducing the time and resources needed for traditional loan processes. As a result, Ant Financial has become one of the largest fintech companies globally, with over 1 billion users.

Conclusion

The integration of AI in fintech banking is revolutionizing the financial industry, offering unprecedented benefits to tech-savvy consumers and small business owners. From enhanced accessibility and cost-efficiency to continuous innovation, fintech banks are setting new standards in the banking sector.

By leveraging AI, fintech banks are providing personalized, data-driven financial solutions that meet the evolving needs of their customers. As AI technology continues to advance, the future of fintech banking looks promising, with even more innovative solutions on the horizon.

If you’re a business professional or a tech-savvy consumer looking to explore the benefits of fintech banking, now is the time to make the switch. Discover the opportunities offered by fintech banks and stay ahead of the curve in this rapidly evolving digital economy. Sign up with Jasper for free today and experience the future of banking.